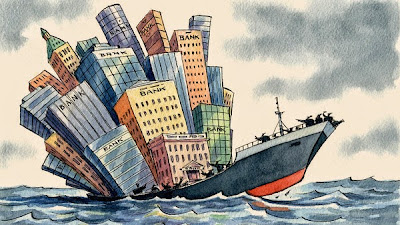

"Is it possible to have too much finance? Harmed by the aftermath of financial crises, enraged by bailouts of financial institutions, irritated by the generous remuneration, aghast at repeated malfeasance and infuriated by the impunity of those responsible, most ordinary people would find it all too easy to answer: yes."

|

| Link to web site (paywall) |

"... An organised society offers two ways of becoming rich. The normal way has been to exercise monopoly power. Historically, monopoly control over land, usually seized by force, has been the main route to wealth. A competitive market economy offers a socially more desirable alternative: invention and production of goods and services.

"Alas, it is also possible to extract rents in markets. The financial sector with its complexity and implicit subsidies is in an excellent position to do so. But such practices do not only shift money from a large number of poorer people to a smaller number of richer ones. It may also gravely damage the economy.

"This is the argument of Luigi Zingales of Chicago Booth School, a strong believer in free markets, in his presidential address to the American Finance Association. The harms take two forms. The first is direct damage: an unsustainable credit-fuelled boom, say. Another is indirect damage that results from a breakdown in trust in a financial arrangements, due to crises, pervasive 'duping', or both.

No comments:

Post a Comment